Article

5 min read

How to create a payslip

Brett Smith

Jun 14, 2021

Chapters

How To Create A Payslip

Payslips have changed a lot in the past few decades. Twenty years ago, employees would expect to receive a paper payslip as a record of their income and deductions.

While many companies worldwide (especially smaller businesses) still offer paper payslips, it’s much more common today for all records to be kept online in a safer virtual environment. Whether you prefer to use an online-only system for your workforce or print paper payslips as an additional record for them, the simplest way to create payslips is by using a dedicated piece of software.

The building blocks of a payslip

A payslip is an informational document for your employee showing how much money they made for the pay period, what deductions were taken out of their gross pay, the amount of each deduction, and their final net pay. Every payslip has to, legally, contain a list of basic elements, including:

- The employee’s name and identification numbers

- The company’s name and contact information

- The employee’s gross pay (the amount earned before deductions)

- The name of each deduction and the amount deducted

- The employee’s net pay (the amount left after deductions are subtracted from the gross pay)

- The method and amount for any partial payment (if some is paid in cash and the rest deposited in an account, for example)

You may include additional information on the payslip such as the rate of pay and the employee’s National Insurance number, but this isn’t necessary.

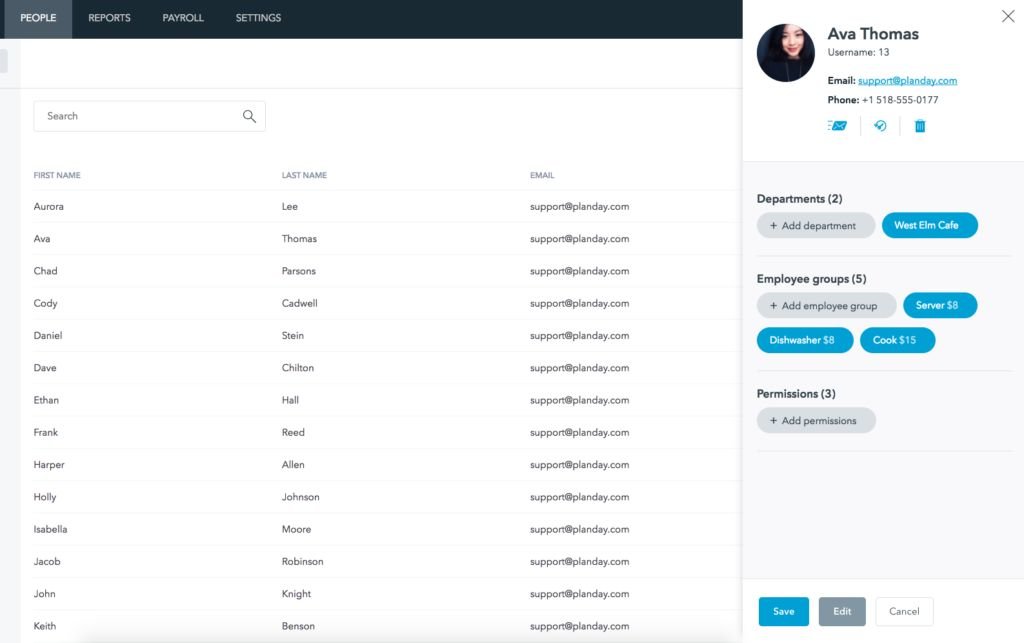

Online payslip creators

The simplest method for creating a payslip system for your employees is to create an account with one of the many online payroll systems available. If your company already uses some form of online or virtual accounting, check to find out if it offers a dedicated payslip template. Since you’ll already have all your financial information stored in the program, it should be a simple task to set up an additional form template to create your employees’ payslips.

If you haven’t yet committed to a particular accounting software, you’ll find a dizzying array of choices online. Spend some time deciding exactly what you need for your business before exploring all the options. The perfect solution for a small restaurant won’t be nearly robust enough for a medium-sized care home.

Try out a few to find the right one for your business. Those payroll solutions that integrate with Planday are all outlined here.

Total DIY

If you take pride in taking care of all your business details on your own, Excel or OpenOffice spreadsheets do allow you to create payslips. Once you have all the basic details in your sheet, you’ll be able to create a basic template, then use it every payday to make an individualised weekly or monthly payslip for each employee.

If you’re not experienced with using spreadsheet programs, invest in a class to familiarise yourself with this type of software. Doing payroll using Excel can pose a steep learning curve if you’re not up to speed and lead to mistakes with salaries.

Begin creating your template by naming the columns. Some columns are basic for every business, but this is where your penchant for individuality will pay off. You can add or remove any column you like to make your template fit perfectly with your payroll needs. Start with a column for employee names, then add columns as needed. Some of the more common examples are:

- Pay rate

- Total hours worked

- Overtime pay rate

- Total overtime hours worked

- Gross pay

- Individualised deductions

- Net pay

Change the font and placement of your column headings to make the template look like you want it to. Centre the words, make them bold or italic or whatever else might make it more pleasant to work with.

Create formulas for the columns when needed. The most convenient thing about these spreadsheet programs is that they keep the drudgery out of payroll by doing the endless small maths problems for you. Not every cell will need a formula, but you’ll have to input one where you want the spreadsheet to figure out gross pay, personal income tax and other deductions, and net pay.

Once you’ve included all the needed formulas, enter an imaginary employee with all of his details to test them out and make sure they work as you expect them to. Once the math is correct, customise the template so that your payslips will match your company branding, then save the program until needed during the next payroll period.

Get a free scheduling template

Want to get started with smarter scheduling to make your payroll simpler? Start today with this free excel template.

Payslips explained

In an effort to help you understand this confusing yet vital piece of paper, we have created this go-to guide.

How to Schedule Your Staff Effectively

Effective management means assembling and nurturing a stellar team that will help make your business successful.