Chapters

Understanding your payslip and how your salary is calculated

Opening your payslip can come with a real mixed bag of emotions. The first thing all of us do is seek out the big bolded number on the bottom to see what our take-home pay is. And all too often, it can go a little something like this:

“Yes! I’ve been paid! Wait a minute, that’s not the amount I was expecting… they’ve taken how much for tax? And what’s that other deduction for? Surely that can’t be right… what does that code mean?”

Sound familiar?

That little slip of paper (or PDF, it’s the 21st century after all) can be really confusing to decipher. But generally, as long as your boss got your hours right, you’ll file it away and forget about it, because you’re sure they have got you covered. Right?

Whilst we’re pretty sure your employer’s finance department know what they’re doing, it can’t hurt for you to be able to interpret those tiny hieroglyphics inscribed on your payslip, or for you to be 100% sure that you’re being paid the right amount. So, in an effort to help you understand this confusing yet vital piece of paper, we have created this go-to guide. We hope it helps you feel a whole lot more confident next payday.

What is a payslip?

A payslip, also referred to as a wage slip, is a document issued by your employer that lists details about your pay before tax, as well as any deductions.

Your payslip itemises the income you earned over the pay period and year-to-date payroll. It should also show taxes and any other deductions that have been taken out of your earnings. Finally, it should show the amount you actually receive (aka your net pay).

Your payslips also serves as a proof of income or employment, which is more often than not required when applying for a loan or form of credit. By reviewing your payslip regularly, you can make sure you’ve been paid correctly and better understand your deductions. There are many details included on a pay stub to help you and your employee keep track of payments and deductions.

Generally, the items on a payslip can be broken down into three parts:

- Basic pay

- Taxes, deductions and contributions

- Net pay

To understand what information is included in a payslip, take a look at each category we’ve detailed below.

Is my employer legally obligated to provide a payslip?

Yes! The Payment of Wages Act 1991 grants all employees the right to a payslip.

And as of April 2019, The Employment Rights Act 1996 (Itemised Pay Statement) (Amendment) Order 2018 came into effect, which stipulates that your employer is required to list details on the number of hours being paid out on your payslip.

There are some exceptions: anyone who isn’t classified as an employee, such as contractors and freelancers, are not entitled to receive a payslip.

When should I receive my payslips?

Payslip law also states that your employer must make your payslip available to you either on or before the day you’re getting paid. This will vary depending on the type of business you work for – some paydays will fall on the same day every month, while others pay every four weeks.

What are the key details I should expect to find on my payslip?

By law, UK payslips must contain the following information:

- The total amount you’ve been paid before compulsory deductions have been made (your gross pay).

- The amounts of variable deductions taken from your gross pay, and what these deductions are for. These include things like tax and National Insurance (NI).

- The total amount of any fixed deductions taken from your gross pay. These don’t change from payday to payday, for example, union fees.

- The total amount of pay you take home after deductions (your net pay).

- The amount and method for payments. If your employer has paid you part cash, and part bank transfer, for example, that has to be made clear on your payslip.

Am I entitled to ask for a paper payslip?

Employers can choose whether they provide hard copy or digital payslips.

How long should I keep hold of my payslips?

While payslips technically only need to be kept until you’ve been issued your P45/P60, HMRC (Her Majesty’s Revenue and Customs) advises all employees to hang onto their payslips for as long as they possibly can.

At minimum, you should keep your records for at least 22 months after the end of the tax year the tax return is for. It’s also advisable to keep a record of payslips that show proof of pension contributions. Payslips are well worth holding onto for a few reasons – you never know when you might need them for a rent or mortgage application or to resolve pay queries down the line.

What’s the Pay As You Earn (PAYE) system?

The UK operates on a Pay As You Earn (PAYE) system, which is essentially a method of paying tax and National Insurance (NI) contributions during the year.

In essence, your employer withholds taxes due from you from your pay or pension before paying you your wages. At the end of the tax year, you will receive a form, known as a P60, which outlines out the total amount you were paid for the previous tax year along with any deductions.

How to read your payslip

If you, like many workers today, have your payslip deposited electronically, it may have been a while since you actually gave it more than a cursory glance. And if you have checked it out recently, did you really understand everything on it?

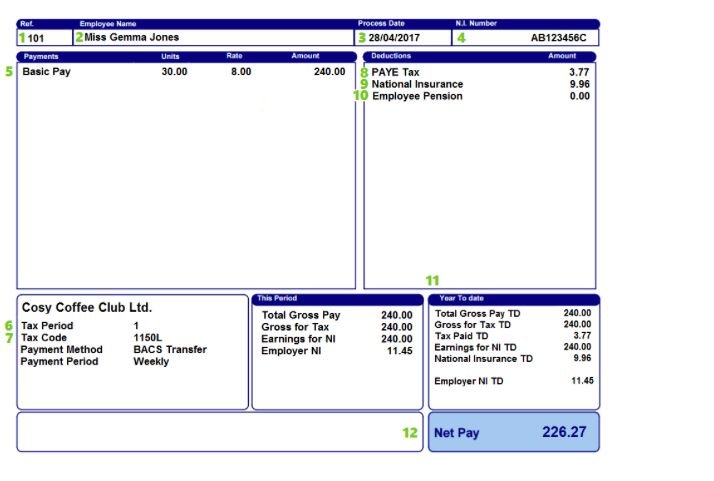

The below is a basic, UK payslip. It’s been numbered to help you recognise and understand the different things written on it, and each number corresponds to an explanation below.

Here’s what a pay slip looks like:

1. Your payroll number

Your payroll (or employee) number is the number used by your employer to identify you for payroll purposes. If you have an issue with your pay and need to speak to your employer about it, it’s useful to have this to hand.

2. Your personal information

Your name and sometimes your home address will usually be shown on your payslip. Remember to keep your employer updated if either of these things change as they’ll need to update their records.

3. The date

The date on your payslip is usually the date that your pay will be credited to your bank account. Legally, you should receive your payslip on or before this date.

4. Your National Insurance (NI) number

Your National Insurance (NI) number is the number used by HMRC to differentiate you from everyone else in the UK.

It ensures that any tax and national insurance contributions you make are recorded against your name, and helps you to build up your entitlement to state benefits, like pensions. In essence, it’s like a personal account number, and it stays the same throughout your entire life, even if you change your name. You must have an NI number to work in the UK.

5. Your base pay

This is the part of the pay stub that shows what you make before taxes, contributions and other deductions. This amount doesn’t include additional earnings that might push your total compensation higher than your base pay.

This is known as gross pay, which includes your base pay plus any overtime pay, bonuses or commissions for the pay period (if applicable).

6. The tax period

This one’s a bit confusing as the tax year in the UK runs from April 6th each year until April 5th of the following year and is broken up into different tax periods. These tax periods are what decide the tax and national insurance thresholds used to calculate your pay. If you’re paid monthly, for example, April 2019 was tax month 1 and December 2019 will be counted as tax month 9.

7. Your tax code

Your tax code tells your employer how much tax-free pay you should get before they start deducting tax. Most people in the UK who have one job or pension are on the tax code 1150L. If you are on this code, it means that in that tax year, you can earn up to £11,850 before you start paying tax.

Once you earn this amount, HMRC will start deducting a percentage of whatever you earn on top of this, and the percentage they deduct will depend on how much they expect you to earn that year. Currently in the UK, the basic tax rate is 20%, and you will pay basic tax rate if, like most people in the UK, you earn less than £37,500 a year.

Basically, this all boils down to the fact that currently in the UK, 20% of the amount you earn between £5,000 and £37,500 is deducted for tax. This information covers the majority of hourly workers’ tax codes, but if yours is different, check it at GOV.UK. If your tax code is wrong, you could end up paying too much or too little tax, so it’s really important that you check it regularly.

8. Your tax deductions

This figure tells you how much tax has been deducted from your gross pay. As mentioned above, this amount is determined by your tax code. If you are earning less than £45,000 a year, it should never be more than 20% of your gross pay, but generally should be significantly less than that.

If you think you are being taxed too much, check your tax code. Codes to look out for include any that end with “W1” or “M1”, as these are emergency tax codes which are applied when HMRC has insufficient information about your income and tax details.

If you have a second job, you might find that your tax code is BR, which stands for Basic Rate. If your tax code is BR, all of your income from this job will be taxed at the basic rate of 20%, as HMRC assume your tax free allowance has been used up when determining tax deductions for your primary job. If this is not the case, you should contact HMRC.

9. Any National Insurance (NI) deductions

National Insurance (NI) contributions are deducted from your pay if you are an employee earning more than £166 a week. The government uses these contributions to pay for things like pensions and maternity allowance.

NI is deducted at a rate of 12% of your earnings above £166 a week, and 2% of your earnings above £962 a week.

10. Your pension details

If you’re paying towards a workplace pension the amount you’re contributing will be shown here. If you see “ER pension” on your pension, that’s the money your employer contributes to your pension pot, while “EE pension” is the amount you’re contributing out of your own earnings.

As of 2018, all employers must provide a workplace pension scheme, enrol you into it, and contribute towards it if:

- You’re classed as a “worker”

- You’re aged between 22 and State Pension age

- You earn at least £10,000 per year

- You usually work in the UK

However, you are able to “opt out” of this pension scheme if you wish. For more information on pensions, see GOV.UK.

11. The pay year to date

Some payslips will show how much you have been paid in the current financial year (usually shortened to TD or YTD on your payslip). They might also show you how much in total you have paid in tax and NI.

12. Your net pay

This is arguably the most important figure on your payslip, as it tells you the amount that you will take home after deductions are made. It’s a good idea to check this against your bank statement to make sure you’ve been paid the correct amount.

Confused by other terms on your payslip?

Here’s the lowdown on some other common acronyms and abbreviations that you might come across when reviewing your payslip:

BACS

This is an easy one! BACS stands for Bankers Automated Clearing Services. It’s an electronic system used to make payments directly from one bank account (in this case, your employer’s) to another (yours!). The main type of BACS payment as it pertains to payslips is Direct Debit.

SSP

Statutory Sick Pay (SSP) is paid out in instances that you are unable to work due to illness for four consecutive days or longer.

SMP, SPP, SAP and ShPP

These are all essentially different types of parental pay.

If you’ve recently had a baby you’ll receive Statutory Maternity Pay (SMP). New fathers are also entitled to Statutory Paternity Pay (SPP). For new parents who choose to share time off, your payslip will also outline Shared Parental Pay (ShPP). If you have recently adopted a child, you’re eligible to receive Statutory Adoption Pay (SAP).

BA

Bereavement Allowance (BA) is a weekly benefit paid out to widows, widowers or surviving civil partners.

CHB

This stands for Child Benefit, which is paid out to parents with children under the age of 16.

CTC

Child Tax Credits or (CTC) are also for parents with children under 16.

I think my payslip might be incorrect! What should I do?

If you’ve read this guide and you’re concerned that your pay isn’t quite what it should be, don’t be afraid to speak up. Take your payslip to your employer’s payroll department and talk to them about your concerns – that’s what they’re there for! Employing hourly workers can be challenging for even the most well intentioned of payroll departments, and sometimes honest mistakes happen. They can’t fix it if they don’t know about it.

That being said, if your employer seems to have trouble tracking your hours, why not tell them about Planday? Our easy-to-use app has a punch clock facility that allows you to clock in and out of work using your smartphone, so when you use it, you can be sure that you’re going to get paid for all of your hard work when payday rolls around.

How to create a payslip

Whether you prefer to use an online-only system for your workforce or print paper payslips as an additional record for them, the simplest way to create payslips is by using a dedicated piece of software.

How the gig economy is changing work

Workers can now take advantage of job opportunities and working agreements that were previously not open to them, while businesses have access to more diverse talent, made available to them through the gig economy.

5 Types of Difficult Customers and How to Handle Them

You know you will meet them one day. Perhaps you have already met them. But did you handle them appropriately?